The Afterword: When life gives you lemons, squeeze and watch the free market crumble

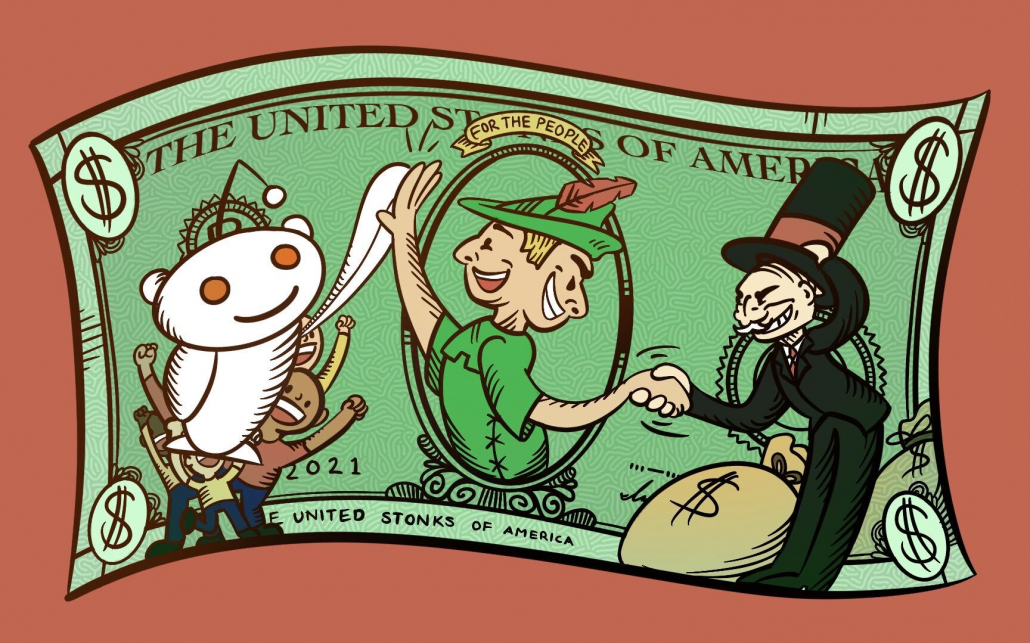

In all seriousness, I never thought watching “The Big Short” would become so useful to my Daily Trojan Arts & Entertainment column. That being said, I guess a group of Reddit users upending the stock market in a modern-day David vs. Goliath upset isn’t the most predictable thing, either. An almost poetic demonstration of the rule-bending hypocrisy of existing power structures that took over the internet last week, I think this is a moment in history — and, specifically, in pop culture — worth documenting.

Now, I’m not a business major (thank God), so bear with me as I attempt to summarize what went down. Basically, a swarm of Reddit users in a Reddit threat called r/WallStreetBets screwed over hedge-fund billionaires — big time. GameStop, along with other companies such as AMC and Nokia, has been down bad thanks to the pandemic’s financial consequences and general trouble in the retail world. Rich hedge-fund guys (we’ll call them finance bros, for clarity’s sake) were able to bet that GameStop would, in a word, fail because the stock market allows traders to bet against companies like GameStop and profit if the value of the asset falls — this is called “shorting” a stock. Given the dismal state of the economy and predictable shift toward oblivion for retail companies like GameStop, the finance bros’ shorting plan seemed foolproof.

That is, until Reddit users took to Robinhood, a user-friendly app that makes it easy for the average person to trade stocks, and invested en masse (we’re talking millions of shares) in GameStop. This effectively increased the value of the asset, contrary to what the finance bros predicted. In economic terms, this is referred to as a “short squeeze,” in which a stock jumps sharply, forcing traders who had bet that its price would fall to buy it in order to forestall even greater losses.

The magnitude of the squeeze was such that it started bleeding over into other threatened companies, such as AMC and Nokia. Financial data company S3 Partners said on Jan. 27 that its analysis found that short-sellers (finance bros) had lost $23.6 billion on GameStop this month, spelling big bucks for amateur Reddit traders. The same day, GameStop’s share price reached $380 , cementing a 1,700% rise in its stock value this January.

What seemed like a well-deserved victory for the masses was abysmally short-lived, however. The next day, Jan. 28, Robinhood and other brokers restricted trading in several securities (including GameStop, Nokia and AMC — the latter of which also saw its shares soar by almost 300%), blocking buyers from purchasing additional shares while allowing hedge funds to freely sell and trade them as they saw fit. It’s like a soccer or basketball game where the team you like is winning, so the ref decides to add an extra 20 minutes but bans your guys from touching the ball — objectively unjust on its face. The decision made by Robinhood (and whichever big dogs their management is in cahoots with) prompted widespread outrage and swift legal obstacles: Some Reddit users have joined a class-action suit against the platform, alleging it manipulated the market by restricting trades.

Again, I’m not a business major — I’m a psychology major. So, while giving the context of the short squeeze is necessary to understand its implications, I’m much more interested in examining this issue through a sociological lens than an economic one.

For one, the collective outrage at Robinhood’s decision to restrict trading has united figures from opposite sides of the political spectrum — a rare occurrence in our increasingly partisan, polarized world. A week ago, would you have believed me if I told you that Donald Trump Jr. and Rep. Alexandria Ocasio-Cortez would have even remotely reconcilable stances on a hot-button topic? Well, believe it: Ocasio-Cortez called swiftly for a congressional hearing to investigate Robinhood’s decision, while Trump Jr. tweeted: “It took less than a day for big tech, big government and the corporate media to spring into action and begin colluding to protect their hedge fund buddies on Wall Street. This is what a rigged system looks like, folks!”

As I followed the scandal’s progression on social media, I picked up on emotions ranging from incredulous shock to cynical contempt and unfettered rage. It was messy — the reaction one might expect when a fundamental building block of the economy is, in the span of 24 hours, broken down and exposed for its reliance on sustaining uneven power structures, pandering to the wealthy and throwing everyone else under the bus when it’s convenient.

The nature of the market manipulation was blatant and shameless, rendering it impossible to ignore no matter what your politics are. Let’s take a look at a couple of tweets that stood out to me in the aftermath of the short squeeze, tweets that I feel capture the heart of this controversy.

@BethLynch2020 tweeted, “no, for real, the stock market soared to record highs as 400,000 people died, and as 50 million people filed for unemployment, billionaires became $1 trillion richer. But, now that regular people are gaming it, these criminals want regulations.”

I mean, really? The Wall Street establishment has historically and consistently treated the market like a Vegas casino, but now that ‘“regular people” have cracked the code, suddenly it’s a dire legal problem demanding immediate attention.

@rudy_betrayed pointed out, “remember when senators got coronavirus briefings before the public and sold off millions of dollars in stocks before the crash last year and faced no consequences and no regulation? then reddit made one stock into a meme and they’re talking about restructuring the whole market.” I think this one speaks for itself. No comment.

My personal favorite came from user @JYSexton, who tweeted, “Robin Hood marketing itself as a business to ‘democratize investment’ and then capitulating to the demands of the elite few is a great time to remember that businesses sell themselves on progressive sloganeering in order to profit off your political sensibilities.”

The irony is overwhelming. You couldn’t write it better: Robinhood, a platform named after a vigilante who stole from the rich to give back to the poor, has come under fire for stealing from the poor to protect the rich. The so-called “free” market looks a lot like a sheep in wolf’s clothing to me.

I am not economically savvy, and I have no idea how this issue will progress or how the market will react and evolve because of it. However, Robinhood’s decision to restrict trading on Thursday confirmed my greatest fear and that of many others: The uber-wealthy — in this case, hedge-fund billionaires in particular — will always get what they want. Until the system is reformed, until checks and balances are implemented and until legislators work actively to circumvent the disproportionate allocation of capital, hedge-fund billionaires will always get bailed out and working-class people will always end up paying the price in their place. If you weren’t sure of that before, you better be now.

As a journalist, I feel an obligation to observe, report and analyze. I feel inclined to ask what the past week’s events and our collective reaction to them say about us and about the world we live in. Oftentimes, I turn to social media to explore these questions because I do believe it will be the enduring mythology of our generation, the stuff of textbooks for generations to come.

I pitched this column in the hope of discussing pop culture from a sociopolitical lens and getting to do just that has only reinforced that the vehicles of expression that surround us most intimately — Twitter, Instagram, TikTok, Reddit — offer an excellent glimpse into the zeitgeist of the twenty-first century. Last week was a jarring, memorable example of how connected our channels of communication are to our identities, and it’s a crazy thing to think about.

Rachel McKenzie is a senior writing about pop culture. Her column, “The Afterword,” typically runs every other Wednesday.