FINANCE: Expert talks FTX collapse, crypto risks

The beleaguered cryptocurrency industry has faced severe scrutiny from policymakers and regulators following a series of high-profile insolvencies.

Most notably, crypto exchange FTX — a broker-like service that provided a platform on which customers could buy and sell cryptocurrency, and that was once worth $32 billion — listed for Chapter 11 bankruptcy in November amid a flurry of financial fraud filings against its founder, Sam Bankman-Fried. Bankman-Fried was arrested in the Bahamas Dec. 12 on charges of wire fraud, conspiracy to commit money laundering and conspiracy to misuse customer funds, and has agreed to be extradited to the United States.

Following the FTX fallout, the bank Silvergate Capital saw its shares tank by over 40% last week after fourth-quarter results showed massive customer withdrawals. Silvergate, once earmarked as an essential service in the crypto market and endorsed by Bankman-Fried, is a bank that offers traditional financial services and a payment network to crypto companies, including exchanges such as FTX. Silvergate has faced calls for answers from policy figures, including, Senator Elizabeth Warren as allegations of its instrumental role in defrauding FTX customers have come to light.

Michael Simkovic, the Leon Benwell professor of law and accounting at the Gould School of Law, spoke with the Daily Trojan to discuss the risk inherent to the cryptocurrency industry and whether companies should be given the protection of government guarantees. Silvergate offers U.S. dollar-denominated loans and takes relatively risky cryptocurrency as collateral, and Simkovic said its recent losses could come out of government entities’ pockets and increase costs to the broader financial system. He also postulates that cryptocurrency could end up hurting those who have not invested in cryptocurrency themselves.

Simkovic placed a lens on the role of government in allowing the problems with banks like Silvergate that place large bets on cryptocurrency to become larger. He said that such companies should not be given government guarantees, and that “the traditional financial system would perhaps be better served by excluding those sorts of companies from [being] within the protection of government guarantees.”

Simkovic highlighted the important role of government guarantees to the financial system, describing how guarantees from entities like the Federal Deposit Insurance Corporation (that backs Silvergate) and the Treasury mean that banks are able to tell their depositors that their money is safe.

“The deal is … if anything bad happens to us, [the government entities will] make sure that you do not lose a dime and you will be fine,” Simkovic said. “That makes people trust banks and feel comfortable leaving their money with the banks even at a relatively low interest rate.”

“The problem,” Simkovic said, “is if they start taking too much risk that raises costs to the government to make good on those guarantees, and the regulations are typically in place to limit how much risk the banks can take since they do have those guarantees. It’s unclear whether it is advisable to allow banks to be placing large bets on cryptocurrency. It’s extremely risky. It’s very speculative.”

While venture capitalists have the right to invest in cryptocurrencies, Simkovic said that government backed entities are, by nature, supposed to be more conservative.

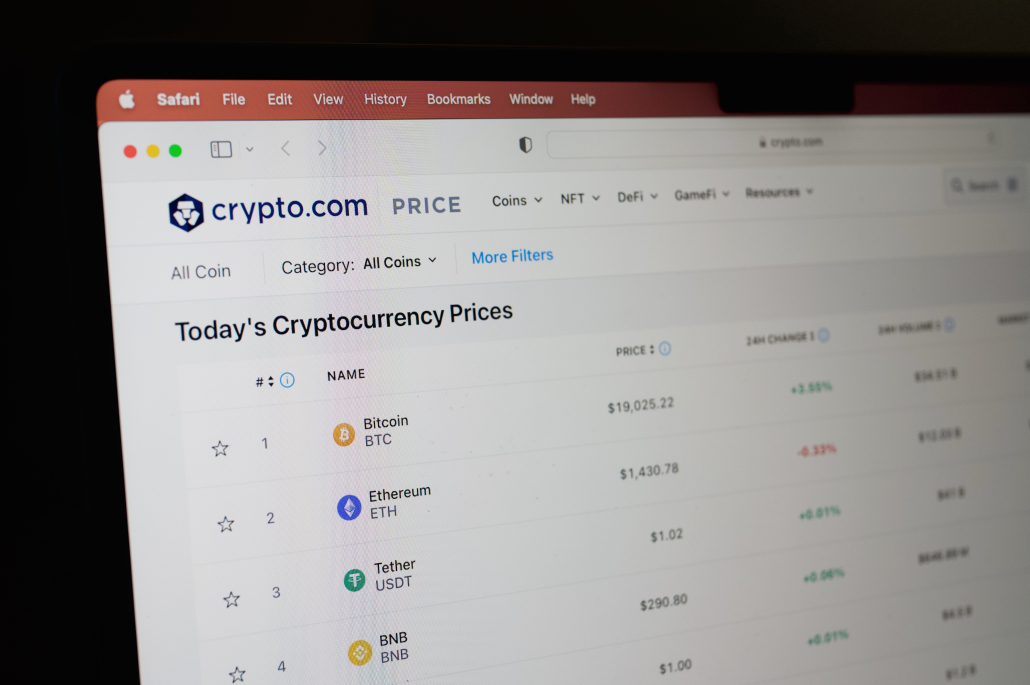

Since the inception of Bitcoin as the first cryptocurrency in 2009, more than 21,000 different cryptocurrencies have been created, totalling to a value of around $804 billion. Around 21% of American adults are said to have owned cryptocurrency as of last year, and banks like J.P. Morgan have started their own cryptocurrency. Even countries have begun to accept it as legal tender. However, Simkovic said he doubted cryptocurrency will go on to play a large role in the financial system.

“I’ve heard many of the arguments in favor of cryptocurrency,” he said. “[For] pretty much every argument I’ve heard, the existing financial system can do what cryptocurrency is supposed to do, and often … [they] can do it better.”

Cryptocurrency also facilitates illegal and criminal transactions, Simkovic said, including “tax avoidance, regulatory avoidance, money laundering, terrorism” and “illegal transactions involving drugs.”

“If you are doing something which is completely legal and you make a transaction through a traditional financial institution, your financial institution knows what you’re doing,” Simkovic said. “But that information is not directly transmitted to the government — it’s only transmitted if you come under investigation.”

The impact goes well beyond the safety of American citizens, Simkovic said.

“Even if Silvergate’s customers are not U.S. citizens, its activities still affect the U.S. financial system and ultimately could affect U.S. taxpayers,” Simkovic said.