Students can receive up to $10,000 in tax credits

College students could receive up to $10,000 in tax credits over the course of their education as part of an extension of the American Opportunity Tax Credit.

U.S. Treasury Secretary Tim Geithner and U.S. Secretary of Education Arne Duncan unveiled the revised AOTC on Thursday to students and parents at Woodrow Wilson Senior High School in Washington, D.C.

The goal of the AOTC is to make college financially attainable for all Americans and to alleviate the rising costs of a college education.

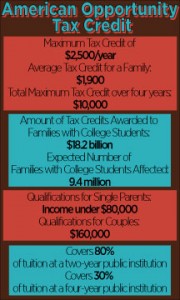

Individuals making less than $80,000 a year and married couples making less than $160,000 a year will qualify for the AOTC, according to the Internal Revenue Service. Approximately 9.4 million students with college students are expected to qualify for the AOTC this year, according to a Treasury Department analysis.

The AOTC, which was initially passed under the American Recovery and Reinvestment Act of 2009, is an expansion of the Hope Credit.

Unlike the Hope Credit, which only covered the first two years of a college student’s education, the AOTC covers four years of post-secondary education with a maximum tax credit of $2,500 per year. The AOTC also provides an allowance for textbooks.

The AOTC is expected to cover 80 percent of tuition and fees at a two-year public college or 30 percent of tuition and fees at a four-year public college, according to a Treasury analysis.

Thomas McWhorter, executive director of financial aid at USC, sees the AOTC as positive news for both current and prospective students and their families.

“I certainly think that [the AOTC] will help families,” McWhorter said. “We can exclude an additional $2,500 from [a family’s] income when assessing them for financial aid.”

The average family is expected to receive a tax credit of $1,900.

Grace Paek, a freshman majoring in health and humanities, said she is excited about the AOTC, but worries that a $2,500 tax credit will not significantly benefit a family with a college student.

“I’m glad [Obama] is looking at rising tuition costs, but I don’t know if $2,500 will do that much,” Paek said. “College tuition is rising so quickly.”

Samantha Gurash, a freshman majoring in writing for screen and television, questions how the AOTC will be funded.

“In theory I agree with the [AOTC],” Gurash said. “But I want to know where the money is coming from because there are so many other things that need to be paid off right now.”

In a joint blog post, Geithner and Duncan discussed the correlation between a well-educated population and America’s global economic success.

“The nations that best educate their children today will be the nations that lead the global economy in the 21st century,” they wrote. “In order to have the best-educated workforce, we must help put college education within reach for all students and their families.”

The AOTC is expected to award $18.2 billion in tax credits to students and parents, according to Duncan and Geithner.

Geithner and Duncan also announced the simplification of the Free Application for Federal Student Aid and an increase in Pell grant funding to lessen the financial burden of college tuition.

Comments are closed.