Power and Privilege

Middle-class squeeze

Students in the socioeconomic middle are pinched by rising tuition, but they don’t qualify for financial aid.

By Shauli Bar-On and Karan Nevatia

Ashley Chen, a freshman majoring in neuroscience, submitted her college applications in Fall 2016 alongside hundreds of thousands of other students. But as she filled out her Free Application for Federal Student Aid, she realized it would reflect her family’s financial standing inaccurately. Chen’s father had lost his job, but her application could not reflect this change until the following year.

Thomas McWhorter, USC’s dean of financial aid, said the University takes special circumstances like Chen’s into account. But when she petitioned the financial aid office, she said she was awarded more unsubsidized loans, increasing the debts she would accumulate upon graduation. Chen is a recipient of the Presidential Scholarship, a half-tuition merit scholarship, but said her family is still stretched financially by having to pay for her tuition.

“Savings aren’t going to last forever,” Chen said. “I’m just really worried about what’s gonna happen next year. I know tuition is only going to hike and even though the merit scholarship will continue to be 50 percent every year, it’s still growing.”

As USC works to provide aid and scholarships for low-income students, those in the middle of the socioeconomic spectrum are suffering. Chen said she was frustrated with the University’s financial aid office and became even more upset when she saw the events it was hosting, particularly USC Village’s donor gala.

“When they had the evening gala in the Village ... I just could not believe how much money they spent just on the light show,” Chen said. “And I understand it’s for the donors, the donors must have donated many, many times more than that, but the money that they are donating is for the students ... not for USC to set up extravagant events for them.”

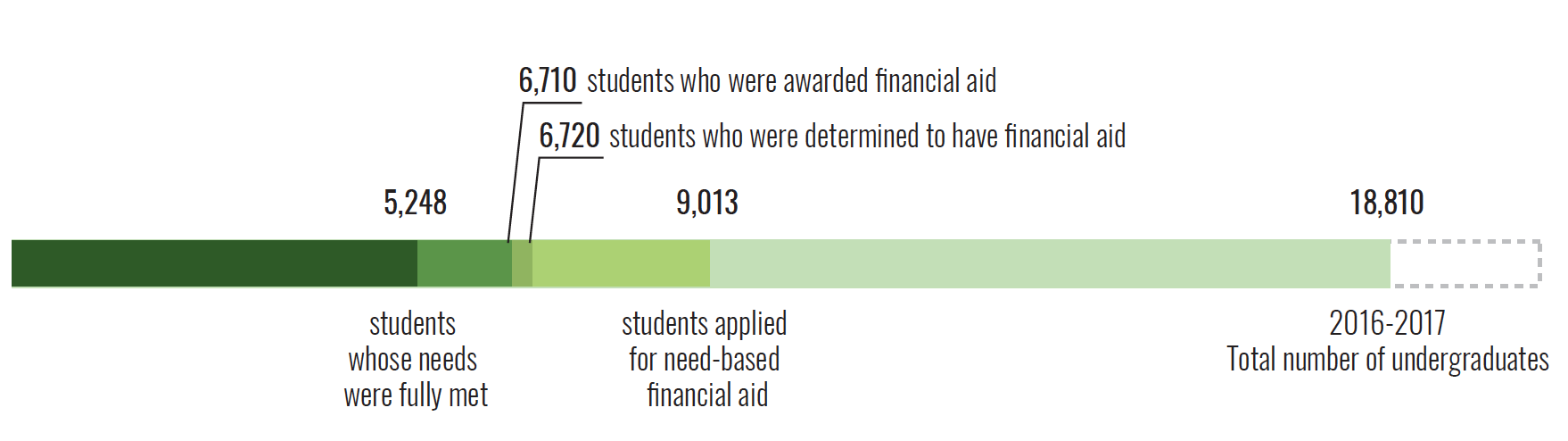

At the same time, McWhorter said the University meets 100 percent of demonstrated need with a generous $330 million in financial aid. He said the financial aid office wants to help, and encourages students to come in and talk to them if they feel their need isn’t being met.

According to the National Center for Education Statistics, 64 percent of full-time beginning undergraduate students at USC received some form of financial aid in the 2015-16 academic year, either through scholarships or federal grants.

For upper-middle income ($75,000 to $100,000) students who do qualify for federal need-based financial aid, USC’s estimated net price for the 2016-17 year is $28,010, a decrease of 13.8 percent over the last four years.

The University even boasts lower average student debt after college than the national average. 2016 graduates left with $22,375 in average debt, according to the U.S. Department of Education, while, nationally, college graduates had an average of $37,172 in student debt, according to The Wall Street Journal.

Samantha Lee | DAILY TROJAN

But students like Chen — who don’t qualify for any need-based aid — can still fall through cracks in the system, where what’s considered demonstrated need might not match a family’s realistic need.

“They call it the middle-class squeeze, so basically, some of the students won’t be qualifying for the federal Pell grant won’t be qualifying for the state grants, so that means that their families are [paying] a larger share,” said Tatiana Melguizo, an associate professor at the Rossier School of Education who specializes in the economics of higher education.

One such student is Lauren Oberreiter, a freshman majoring in international relations and global business. Although Oberreiter received approximately $15,000 in merit aid from the University, she didn’t receive any need-based financial aid, and even with her family’s contribution, she estimates that she will graduate with about $80,000 in student debt.

“My parents have saved up about $125,000 for me,” Oberreiter said. “Anything past that is past what they can realistically afford with mortgages, other things [and] they have to save for their retirement.”

Another such student is senior Karlee Hormell majoring in music industry. Hormell’s parents had to mortgage their home for her to attend USC since she was not awarded any financial aid.

“It puts a lot of strain on my family’s financial situation,” Hormell said. “[Mortgaging the house] was not something that was planned for me to go to school. If I were to attend another university that costs a lot less, we would never have had to do that, so that was specific to USC and not receiving financial aid.”

Hormell submitted a FAFSA application her freshman year, and despi

te her family living on a single salary, she was not granted any aid.

“There’s a lot more to a story than what you see on paper. And I think that’s what gets lost in the FAFSA system,” Hormell said. “By putting dollar amounts on students, on people, and what that looks like in reality, I would just say there is more to the story than what they require.”

Melguizo says there are ways that private institutions like USC can better aid students like Oberreiter, Chen and Hormell.

Samantha Lee | DAILY TROJAN

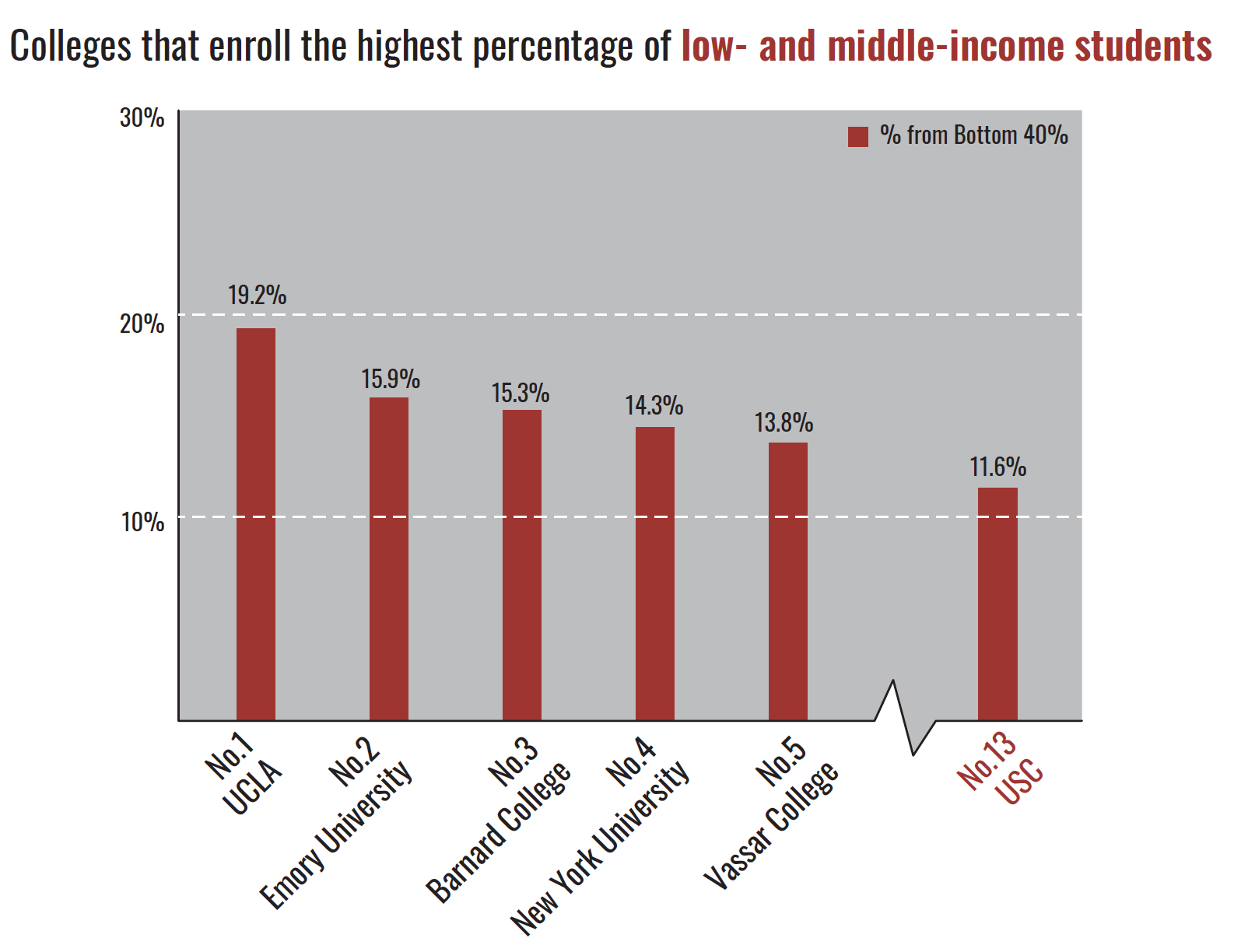

“One thing that universities like USC have is that they have the freedom to ask for more financial information, so they can get a much better sense of the financial reality of a family,” Melguizo said. “This student will be really penalized in UCLA, that has to go through the federal mandate, but I think USC has the resources to really study the characteristics of the family.”

But it’s unclear if that is actually happening. When Oberreiter went to USC’s financial aid office, she said they told her that on paper, she was a millionaire without even knowing it. Because of her family’s assets and savings, her family’s expected contribution for college was $91,000 a year, according to FAFSA calculations.

“[They] said, we get that your family isn’t millionaires, you don’t have access to all that money, but because of the way that it reads, we just can’t offer you any assistance in that way,” Oberreiter explained.

McWhorter said the financial aid office considers these assets to ensure an equitable distribution of funding. Some factors USC uses that aren’t considered under federal methodology include home and business equity and tax adjustments that reduce a family’s reported income.

Samantha Lee | DAILY TROJAN

“As an example, some families may choose to place family savings in investment accounts or college saving plans over time, while others may choose to invest in the family home or their business,” McWhorter said. “Due to the amount of University resources committed to need-based grants, and because of the similar financial strength of such families, we include these assets in the evaluation of a student’s eligibility for need-based aid.”

In some ways, Oberreiter understands this point of view — she thinks middle-class families have just as much of a responsibility as the University does in paying for college tuition.

“It sucks, but I don’t think it’s unmanageable. If I had to pay for all of USC, if my parents hadn’t saved any money, that would be unmanageable, and I would not be here,” Oberreiter said.

Melguizo also said that there are other options that make college more affordable for middle-class families, even if they didn’t think ahead to save for college.

“Middle-class families have a lot of what we call social and cultural capital, and they’re very good at navigating very complex financial aid systems, so that’s something that they clearly have in their advantage,” Melguizo said.

Melguizo cited parental involvement and transferring from a community college as two examples of social and cultural capital. Ultimately, Melguizo doesn’t see the middle class squeeze as the biggest problem in college affordability.

“I don’t personally think there’s such a big squeeze — I think that the fact that university costs are out of control is something that affects everyone, and in some cases, it might affect even more low-income students,” Melguizo said. “As a policymaker, I would be making sure that those extra dollars support the populations of students that would benefit more from that support.”

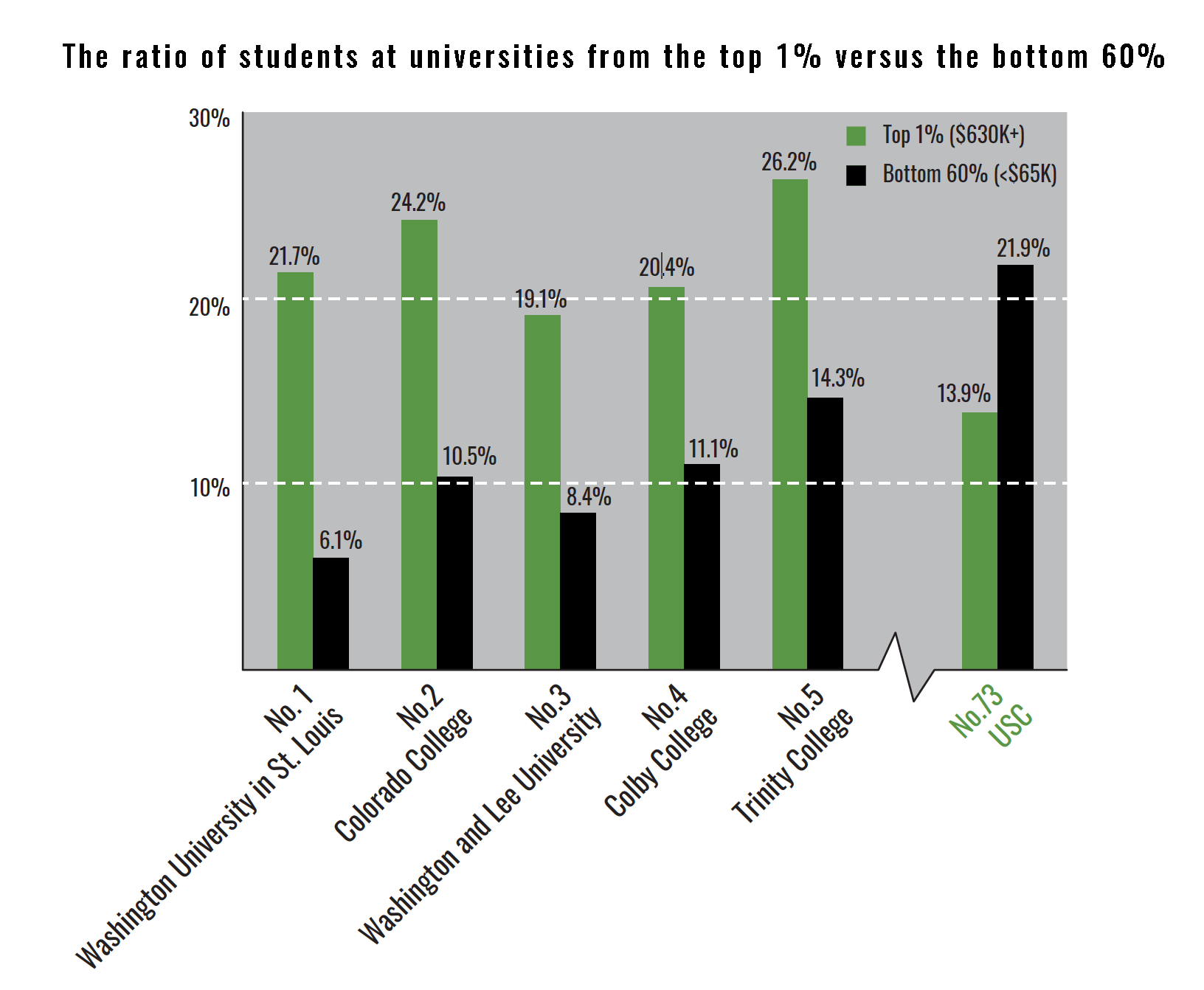

CORRECTION: A previous version of the graphic titled "The ratio of students at universities from the top 1% versus the bottom 60%" mislabeled the color key. The title of the graphic has also been updated for clarity. The Daily Trojan regrets these errors.