Gen Z must speak up about the national debt

Young people are historical agents of change in American democracy. In the early 1970s, college students protested the Vietnam War by storming out of class across nearly 900 campuses nationwide. More recently, David Hogg, Emma Gonzalez, Alex Wind, Cameron Kaskey and Jaclyn Corin were collectively named 2018 TIME Person of the Year for their activism in the wake of the Parkland, Florida shooting.

As young adults, we may not hold the same positions of power as older generations — but what we lack in bureaucracy we make up for in social influence. When young people start talking about something, society starts talking about it.

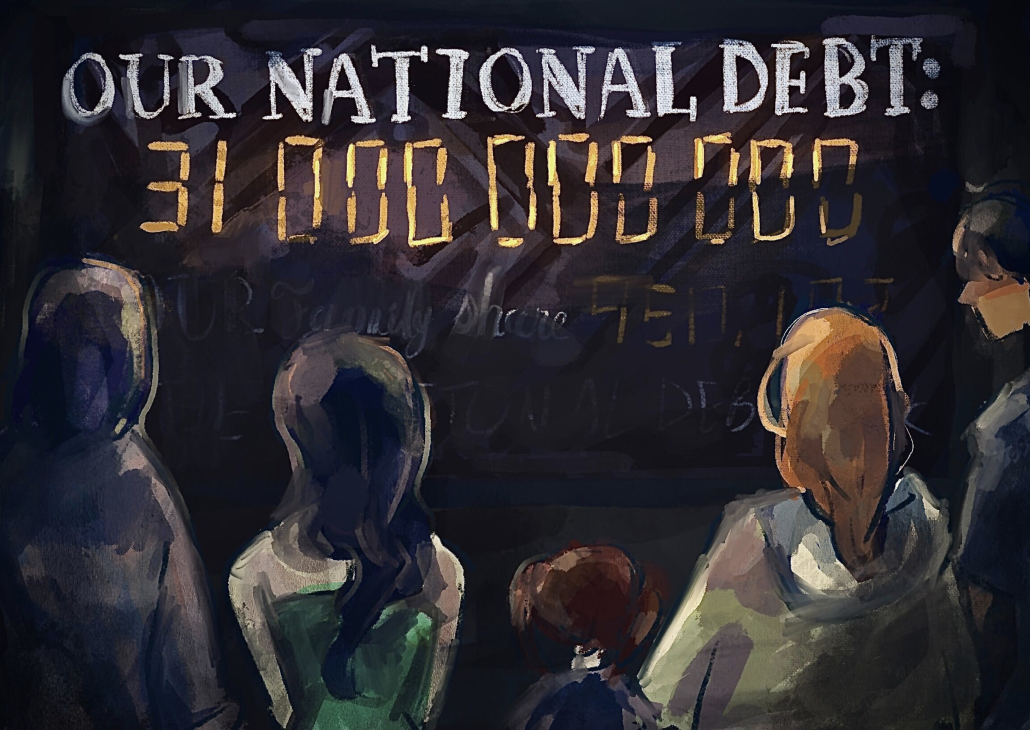

Taking that into consideration, it is ironic that America’s youth refuses to discuss the largest threat to our future — the national debt. I encourage anyone reading this to visit usdebtclock.org. You’ll find that the national debt currently sits at $31 trillion. For comparison, the global population only consists of about 8 billion people.

With Congress running deficits every year since 2001 and showing no signs of slowing, the debt situation is getting more dire every year. Long gone are the Bill Clinton and Newt Gingrich days of budget surpluses. Instead, we somehow find a way to spend more each year than we did the year before. Spending bills in the trillions were unheard of 10 years ago; today this is nothing out of the ordinary.

Career politicians in Washington refuse to address this issue for two reasons. The first is a political argument. Balancing the budget demands unpopular solutions. The options are limited: raise taxes, cut spending or print money. None of these options are what a political scientist would consider a successful campaign initiative for politicians vying for re-election.

Second, politicians and a lot of the people voting for them are already nearing the end of their working careers. By the time the United States needs to pay off the debt, these people won’t be working. The strategy is simple: Spend money today and have our children pay for it later. Imagine going to a restaurant, ordering the most expensive item on the menu and leaving right before the bill arrives.

Eventually, the day will come when we have to pick up the tab that the older generations left on the table. Gen Z and subsequent generations will spend their lifetime earnings paying their parents’ debt. Our taxes will be higher. Our income will be lower. We will be less prosperous than generations before us.

Since we are the ones to deal with the repercussions, the burden falls on us to start the conversation. If we fail to address this, no one will. It is for this reason that I struggle to understand why we do not use our outlets — social media in particular — to raise awareness and put pressure on those in power.

We are a vocal group when it comes to social issues. This is particularly true when it comes to climate change, for example. Greta Thunberg addressed the United Nations at 16 years old. It feels as though every high school in America has an environmental awareness club. March for Our Lives — a student-led movement to end gun violence — held more than 450 protests in 2022 alone. If we are so vocal about social issues, why can’t we apply the same activism toward fiscal matters?

Political partisans will attempt to pin the debt on the opposing party, but this could not be more hypocritical. The only thing Republicans and Democrats like to do more than spend money is to blame the other party for spending money. In the early 2000s, Democrats blasted then President George W. Bush for spending $3 trillion on the war in Iraq. President Obama then proceeded to increase the national debt by $8.6 trillion. After branding himself as the “king of debt,” President Trump increased the national debt by a whopping $7.8 trillion in just four years in office. Coupled with tax cuts that did not pay for themselves, Trump oversaw the third-largest deficit increase in presidential history. In a political climate where Republicans and Democrats can’t seem to agree on anything, perhaps running deficits stands as the lone exception. The problem is we have to pay for their stubborn disagreements.

If you are young and do not think the national debt affects you, you are mistaken. The United States is quickly approaching peak debt — the point at which a country accumulates so much debt that it cannot be paiwd off. The rise of modern monetary theory — a controversial macroeconomic theory that suggests governments can print money without resolve — is most alarming.

If we do not start raising our voice, we will spend our working careers paying the debts cast by our parents. Even our children will be burdened by this. We are proven advocates for social change. It is high time we apply this same effort and passion to fiscal issues. Our future depends on it.