Personal finance IQ pays big dividends

If you think soft money is the dollar bill you dropped in the pool and a stock portfolio is a fancy folder, you’re not alone.

Many college students don’t have the kind of personal finance savvy to guide them to a debt-free life.

Knowing how to spend, earn and save money is as essential to American life as sharing, caring and having social skills — so why doesn’t every high school graduate in the United States know what a mortgage is?

In the midst of a financial crisis where jobs come far and few between, money — and the skills to maximize its use — is the key to creating a generation that can weather the difficult economic recovery we are currently experiencing.

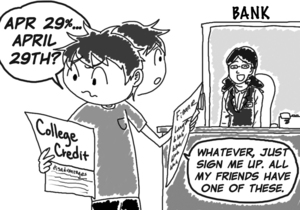

College students are at a crucial time in their lives where they develop the spending and budgeting skills for their adult lives. They often depend on credit cards and student loans, which they might not understand, to get them through school.

Some students can only attribute their knowledge about personal finance to experiences growing up.

It’s normal for students like Alana Muntz, a freshman majoring in political science, to not be completely familiar with terms like “credit score.” She attributed most of what she knew about spending money to her parents.

“My parents gave me an allowance and taught me how to divide it into savings, spending and charity to give to church,” Muntz said.

She also has a credit card.

“My mom set it up for me,” she said. “It’s to establish credit, or something like that.”

Upon applying for a credit card, all the introductory literature spews terms like “APR,” “average daily balance method,” “credit line” — terms not taught in school. It’s up to the individual to care enough to read and truly understand the fine print.

It seems that only certain students like Andy Matsuzaki, a junior majoring in economics, bother to look up what those terms mean.

“You have to have an interest in personal finance,” he said. “I spent time hanging around Barnes & Noble reading up … it was time-consuming and difficult, but I saw the benefits.”

Matsuzaki credited his peers’ poor spending habits to short-term thinking.

“Students don’t have a lot of money in the first place … it doesn’t hit them until it’s overwhelming,” he said.

Short of personal interest and research, however, some students recognize that financial intelligence should have a place in higher education. The fact remains that personal finance should not be an optional pursuit but something all college students should be well versed in.

Caitlin Price, a junior majoring in business administration and accounting, chose to help coordinate a series of personal finance workshops in conjunction with the USC Marshall Partners, an academic support group.

“The major areas we wanted to focus on make or break someone in the finance world,” Price said.

Featuring sessions on housing, budgeting, investing and taxes, the series includes an hour-long program where professionals speak about these intimidating but practical subjects.

Price, whose father works in private equity and mother serves as a brand manager, grew up with a business-oriented mind. She held a full-time job every summer, starting in the sixth grade. After years of hard work, she bought her own car — and now takes full responsibility for her financial life as an aspiring investment banker.

“[Students] need to be educated on finance topics,” she said. “They need to be proactive in their own financial lives.”

Price pinpointed five basic tenets that young spenders should follow. Not only should they know how to manage a budget and what impacts their credit score but also how to do their taxes, understand the true value of money and acknowledge that they are not in a vacuum.

“Students don’t recognize that things like the health care bill will impact them financially,” Price said.

At the end of the day, it is up to us to take responsibility and educate themselves. There’s certainly not a lack of resources.

Sure, the personal finance section of the library may seem dry and dense, but small steps, like reading the Wall Street Journal, looking out for free workshops provided by Marshall, actually reading the cheesy brochures that explain financial concepts at local banks and employing resources such as the Internet, can enable students to take a more active role in their own practical lives — beyond dropping loose change into a piggy bank.

After all, one can never really know when the next rainy day — or recession — will occur.

Clare Sayas is a junior majoring in public relations. Her column “Spitting Cents” runs every other Tuesday.